36+ Investment loan borrowing calculator

Investing in property is often seen as the less risky form of investment unlike stocks or managed funds that can require specialised knowledge to get a foot in the door. The monthly fee is designed to further reduce their risk and improve their return on investment ROI on the loan.

Prosper Moneymade

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

. Key fact sheets All Calculators. Stamp duty calculator Loan repayments calculator Historic inflation calculator Mortgage affordability calculator. Lenders typically charge their clients a rate made up of three parts.

For example a 45 APR would translate to 000375 004512. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. For example the first interest payment on the schedule above would be.

Calculating Payment towards Interest. We assume homeowners insurance is a percentage of your overall home value. A good interest rate on a personal loan is one thats lower than the national averageless than 12 in March 2021.

The resources in this story may also be helpful. To help you see current market conditions and find a local lender current Redmond truck loan rates are published in a table below the calculator. As part of the total loan payment each period the borrower must make a payment towards interest.

Personal loans through Prosper are unsecured. We use current mortgage information when calculating your home affordability. Displayed rate does not represent the actual rate you may receive.

When providing collateral for a secured loan borrowers have a lien placed on the asset used as collateral for the loan and that lien is removed once the loan is paid off. On fixed-rate loans lenders typically charge a higher interest rate for longer duration loans. Homebuyers were confined to borrowing 50 percent to 60 percent of a homes value.

The maximum borrowing amount for a personal loan may depend on the lender though a maximum amount of between 50000 and 100000 is not uncommon. Power Portfolio investment tracker. Interest rates on lines of credit are.

This calculator figures monthly FHA loan payments based on the principal amount borrowed the length of the loan and the annual interest rate. The best way to work out the actual cost of a business overdraft from a bank is to use our business overdraft calculator which is hereYou can find the total actual rate your bank charges you on your latest bank statement. But after establishing the FHA mortgages were insured for 80 percent of the homes value with the remaining 20.

For example a lender might charge 509 for a 10-year fixed rate loan or 575 for a 15-year fixed rate loan. See our competitive term deposit rates today. How to know when you can afford to buy an investment property.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. The APR on the credit. When deciding how long you want the loan period to be it is important to remember that the longer it takes you to pay back the loan the more interest you will have to pay.

Whatever your investment goals let us help you get there sooner with a Heritage Bank Term Deposit. Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Interest is the money you pay to your lender for borrowing funds.

Although the rate will vary after you are approved it will never exceed 36 the maximum allowable for this loan. The rate will not increase more than once per month. Figure out your monthly interest rate.

Usually the fee ranges from 4 to 10 of the outstanding loan balance every 30 days. To pay off balance over 36 months. Related Loan Calculator Interest Calculator Investment Calculator.

Use our loan comparison tool to search for the best unsecured personal loans or unsecured loans. You can use a Personal Loan Calculator to work out how. 36-month balance transfer 269 fee.

Personal loan denials vary but the most common reasons relate to your credit score credit history and income. Secured loans are often used for long. Home Loan repayment calculator.

Interest rates on loans are either fixed or variable. Secured loans are loans that require collateral such as a mortgage or an auto loan. Calculate your interest payment.

That said the actual interest rate youll qualify for depends on several. Commitments were spurred on by a 738 per cent hike in lending for personal investment which saw a decline of 371 per cent in June. The second tab provides a calculator which helps you see how much vehicle you can afford based upon a fixed monthly budget and desired loan term.

Take the APR annual percentage rate and divide it by 12. Purchasing a property such as a house or unit can be quite profitable - especially if the purchaser takes their time to learn about how to reap. The Interest Rate APR and Estimated Monthly Payment assumes the mortgage is a conforming loan to purchase an existing single-family home used as the borrowers primary residence a Loan to Value LTV ratio of 75 or less the borrower has excellent credit a loan amount of 165000 and a 30-year loan term.

Prospective borrowers who have poor damaged or no credit typically find it. Variable rates go up and down according to market conditions. Payments toward principal and payments toward interest.

The lender charges interest as the cost to the borrower of well borrowing the money. Multiply the monthly interest rate by the remaining balance to see how much of your payment goes toward interest. Our personal loan calculator above is the easiest way to compare the different loans available and takes into account the amount you want to borrow along with the loan period.

If you know you will pay your loan off quickly - before rates reset - then it may make sense to choose an adjustable rate option. In basic finance courses lots of time is spent on the computation of the time value of money which can involve 4 or 5 different elements including Present Value PV Future Value FV Interest Rate IY and Number of Periods N. The variable rate is based on the rate published on the 25th day or the next business day of the preceding calendar month rounded to the nearest hundredth of a percent.

Fixed rates stay the same for the entire term of the loan. This calculator figures monthly truck loan payments. Payday loan calculator will help you determine the annual percentage rate APR and total cost of a payday loan.

Before borrowing for big-ticket items consumers establish track records of creditworthiness using sound revolving credit histories and other successful financial transactions to. Loan payments consist of two parts.

2

Free 3 Real Estate Loan Proposal Samples In Pdf

Find Compare Investment Offers Best Investing Platforms Online Start Investing Now

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Zatxjp0fi5andm

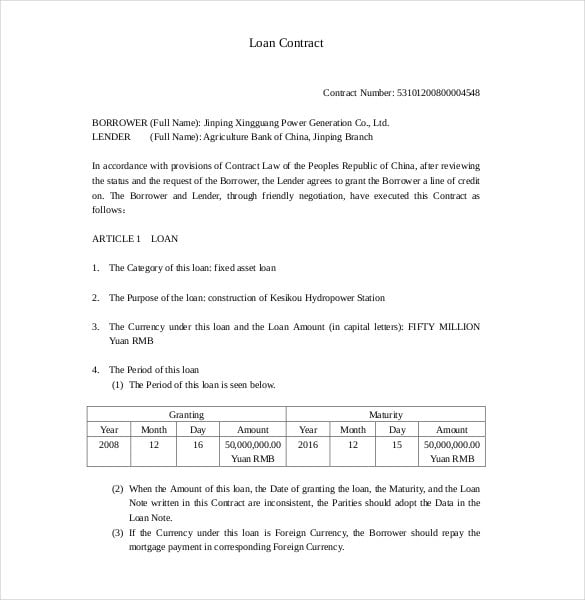

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

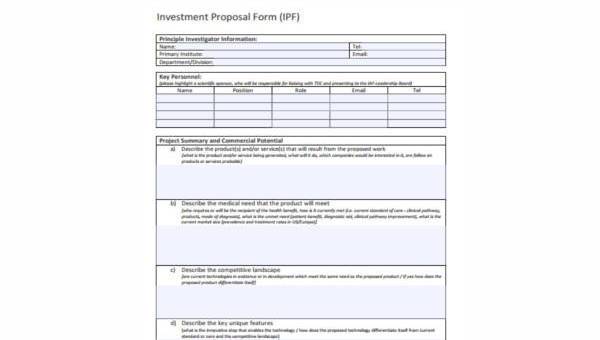

Free 7 Sample Investment Proposal Forms In Pdf Ms Word

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

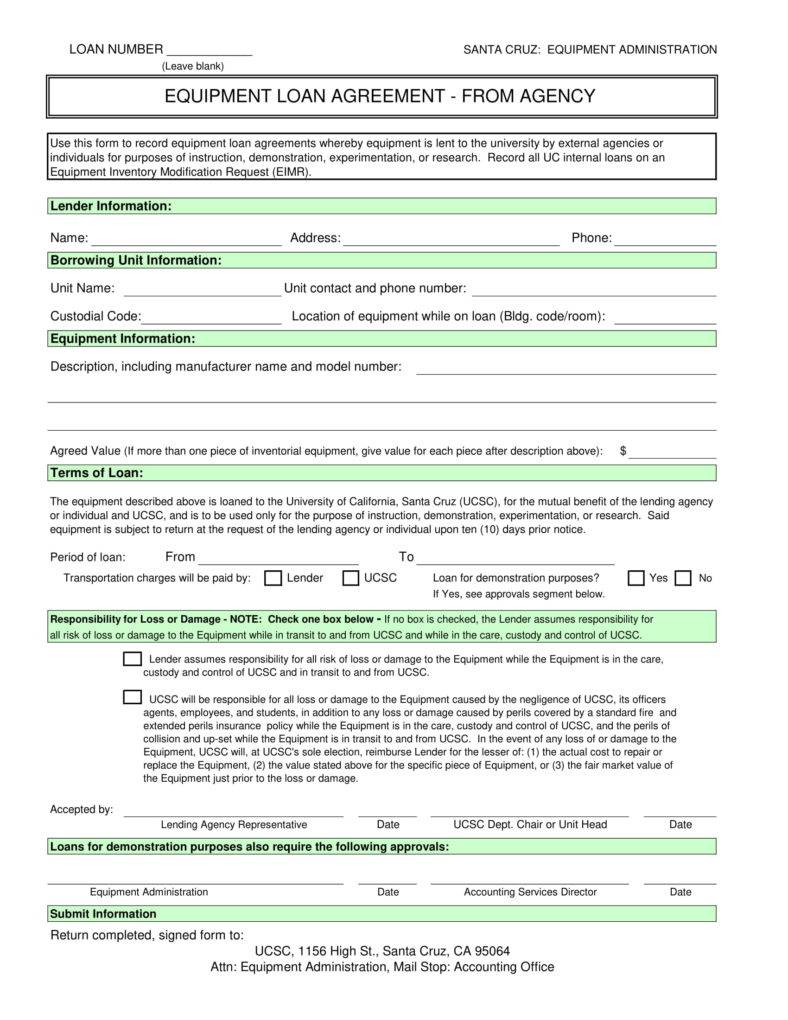

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

Home Loan Comparison Spreadsheet Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Edly Moneymade

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

2

Investing Calculator Borrow Money